Contactless Payment Market Growth Driven by Technological Advancements and Rising Demand for Speedy Secure Payments

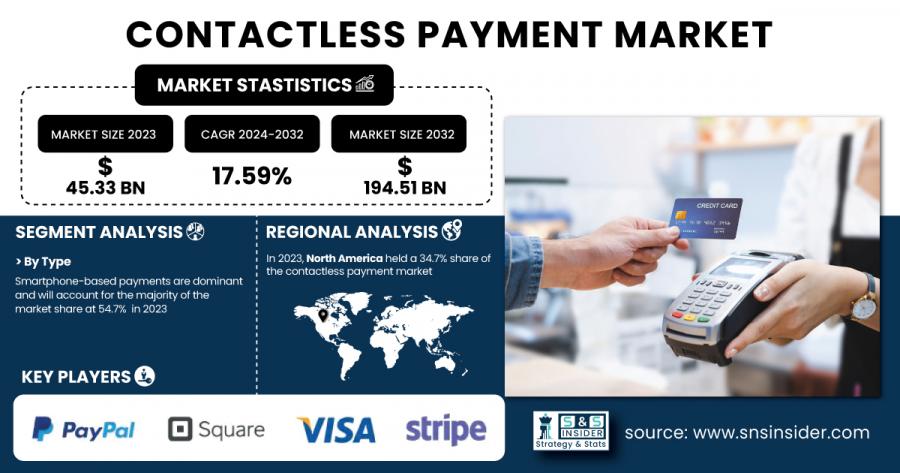

The Contactless Payment Market was USD 45.33 Bn in 2023 and is expected to reach USD 194.51 Bn by 2032, growing at a 17.59% CAGR from 2024 to 2032.

AUSTIN, TX, UNITED STATES, January 30, 2025 /EINPresswire.com/ -- The growth of the Contactless Payment market is driven by the increasing demand for faster, secure, and convenient transactions. Additionally, technological advancements and the shift towards cashless payments are accelerating its adoption.

The Contactless Payment Market was valued at USD 45.33 billion in 2023 and is expected to grow to USD 194.51 billion by 2032, at a CAGR of 17.59% over the forecast period of 2024-2032.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/1499

Some of Major Keyplayers:

- Visa (Visa Contactless Cards, Visa Tap to Pay)

- MasterCard (MasterCard Contactless, MasterPass)

- PayPal (PayPal Wallet, Venmo)

- Square (Square Reader, Cash App)

- Apple (Apple Pay, Apple Card)

- Google (Google Pay, Google Wallet)

- Samsung (Samsung Pay, Samsung Wallet)

- Amazon (Amazon Pay, Amazon One)

- Alipay (Alipay App, Alipay Wallet)

- WeChat Pay (WeChat Wallet, WeChat Mini Programs)

- Adyen (Adyen Payment Platform, Adyen POS Terminal)

- Stripe (Stripe Terminal, Stripe Issuing)

- Ingenico (Ingenico Move/5000, Ingenico AXIUM EX8000)

- Worldpay (Worldpay Total, Worldpay Dashboard)

- FIS (FIS Digital One, FIS RealNet)

- Fiserv (Clover POS Systems, Clover Go)

- NXP Semiconductors (MIFARE ICs, NFC Controllers)

- Infineon Technologies (SECORA Pay, NFC Security Solutions)

- IDEMIA (IDEMIA Contactless Cards, IDEMIA Digital Payment Solutions)

- Thales (Thales EMV Cards, Thales Contactless Payment Solutions)

Rising Demand for Speedy and Secure Payments Drives Growth of Contactless Market

The rising need for faster, more convenient, and secure payments is accelerating the growth of the global contactless payment market. Contactless is providing a frictionless experience, forgoing the need to deal with cash, pass contactless cards from hand to hand, or enter pin numbers all vital to keep consumer nervousness at bay as consumers seek speedier means of payment. The traditional approach to banking is accompanied by smartphones in our hands and wearable devices, which enable users to tap and pay without touching their phones. Furthermore, with people increasingly concerned about safety and hygiene, the pandemic also contributed to a faster shift towards contactless payments, fueling the market growth.

Financial Support and Technological Advances Propel Secure Growth of Contactless Payments

The growing support from financial institutions, merchants, and governments is another key factor driving the contactless payment market. Contactless payment is being integrated by banks and payment service providers which will make this option more convenient for consumers to access. Moreover, the market has been accelerated by regulation schemes that promote digital payments and lower cash reliance. However, with advances such as Near Field Communication (NFC) and the creation of secure encrypted transaction protocols, contactless payments are steadily becoming more secure.

Smartphone Payments Dominate Contactless Market with Rapid Growth in Card and Hospitality

By Type: The contactless payment market was dominated by smartphone-based payments in 2023, propelled by the adoption of mobile wallets and applications that provide convenience and security. As smartphones have become an integral part of our daily lives, the transactions done through smartphone-based applications have risen rapidly due to the seamless and quick transactions.

Card-based payment is projected to grow at the highest CAGR over 2024-2032. As contactless-enabled debit and credit cards are becoming increasingly popular, consumers are now able to use card payments, a highly convenient and reliable way to make secure payments.

By Application: Retail led the contactless payment market in 2023 owing to the growing demand for faster and more convenient payment solutions via stores, supermarkets, and online paid solutions among consumers. This has led to the widespread adoption of contactless payment systems among retailers, to improve customer experience and support faster transactions is expected to further fuel market growth.

Contactless Payment Market Segmentation:

By Type

- Smartphone Based Payments

- Card Based Payments

By Application

- Retail

- Transportation

- Healthcare

- Hospitality

- Others

Enquiry Before Buy this Report: https://www.snsinsider.com/enquiry/1499

Hospitality will develop at the highest CAGR during the forecast period from 2024 to 2032. The cocktails still exist but hotels, restaurants, and travel services are betting on contactless payment solutions to provide a better guest experience reducing physical interaction between guests and Guests at properties.

North America Leads Contactless Payments Market While Asia Pacific Sees Rapid Growth

In 2023, North America remained the leading region in the contactless payment market, capturing a major part of the total market share, mainly due to the trend of highly technological infrastructure, high smartphone usage penetration, digital payment preference, and receiving developed economic conditions. The accelerating consumer adoption of contactless payment solutions, and the backing from prominent financial institutions, have positioned North America to lead this space. Moreover, the proliferation of contactless payment methods has been augmented by the region’s sophisticated retail and e-commerce sector.

Asia Pacific will grow with the highest CAGR during the forecast period 2024-2032. Rapid urbanization, increased smartphone penetration, and further expansion of the digital payment ecosystem are among the factors behind the rising adoption of contactless payment in the region. We see significant technological advancements and governmental support directed towards the cashless transactions landscape in China, India, and Japan, taking the lead as some of the top countries in furthering cashless technology. This will ensure healthy growth of the contactless solutions market as more consumers and businesses in the Asia Pacific continue to adopt these solutions.

Recent Developments:

- In September 2024, Mastercard and Amazon Payment Services partnered to enable digital payment acceptance across the Middle East and Africa, enhancing transaction solutions for merchants.

- In December 2024, Alipay launched its "Tap!" payment service in Guangzhou, China, allowing users to make seamless payments by tapping their smartphones at merchant devices.

- In May 2024, Worldpay launched "Tap to Pay on iPhone," allowing merchants to accept contactless payments directly through their iPhones without extra hardware.

Access Complete Report: https://www.snsinsider.com/reports/contactless-payment-market-1499

Table of Content:

1. Introduction

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

5. Statistical Insights and Trends Reporting

6. Competitive Landscape

7. Contactless Payment Market Segmentation, By Type

8. Contactless Payment Market Segmentation, By Application

9. Regional Analysis

10. Company Profiles

11. Use Cases and Best Practices

12. Conclusion

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release